- /

- Blog /

- Copytrading /

- How to choose the right trader on nomo: key copytrading tools and strategies 📈🛠️

How to choose the right trader on nomo: key copytrading tools and strategies 📈🛠️

Learn how to choose the right trader to copy on nomo with this complete guide on copytrading.

Guide

Share

Copytrading has become an essential tool for investors looking to leverage the expertise of seasoned traders or an ideal option for those just starting their investment journey. However, selecting the right trader to copy on nomo is crucial for maximizing profits and minimizing risks. Here’s a comprehensive guide to help you make the best choice.

Why choosing the right trader matters

Picking the right trader is key to optimizing your investments. Copytrading isn’t just about mirroring any trader’s moves, it’s about selecting those with a proven track record and strategies that align with your investment goals. 📊

Factors to consider when choosing a trader on nomo

👉 Performance History: Analyze the trader’s track record, focusing on long-term results. Look for consistency in returns and avoid those with extreme highs followed by sharp declines.

👉 Trading Strategy: Understand how the trader operates. Some focus on short-term trades, while others prefer medium- or long-term investments. Identify whether they specialize in stocks, commodities, cryptocurrencies, or other assets, and choose one whose strategy matches your preferences.

👉 Risk Level: Assess how much risk the trader takes in their trades. Make sure their risk level aligns with your own risk tolerance. If you’re a conservative investor, look for traders with a more cautious approach.

👉 Transparency: Transparency is essential for building trust. Check if the trader provides clear details about their performance and strategies. Open and detailed communication reflects professionalism and reliability.

👉 Diversification: Look for traders who diversify their portfolios across different assets. Diversification helps reduce potential losses and demonstrates solid risk management.

How to analyze a trader’s performance on nomo

📊 Profitability Charts: Use nomo’s analytics tools to review a trader’s historical performance and profitability trends. Charts provide a clear overview of their track record over time.

🔎 Consistent Returns: Prioritize traders with stable performance, avoiding those with sporadic or highly volatile gains.

⚖️ Trader Comparison: Compare multiple traders with similar profiles to determine which one best suits your investment goals and risk tolerance.

How to evaluate a trader’s Strategy

How to evaluate a trader’s Strategy

📱 Trader Profile: Read the trader’s profile on nomo to understand their investment approach. This will give you insight into their objectives and methods.

📊 Strategy History: Analyze the trader’s preferred asset types, trading frequency, and analytical methods, whether technical, fundamental, or a combination of both.

💬 User Reviews: Check feedback from other investors who have copied the trader. Their experiences can provide valuable insights into the trader’s reliability and performance.

nomo’s tools to help you choose the perfect trader

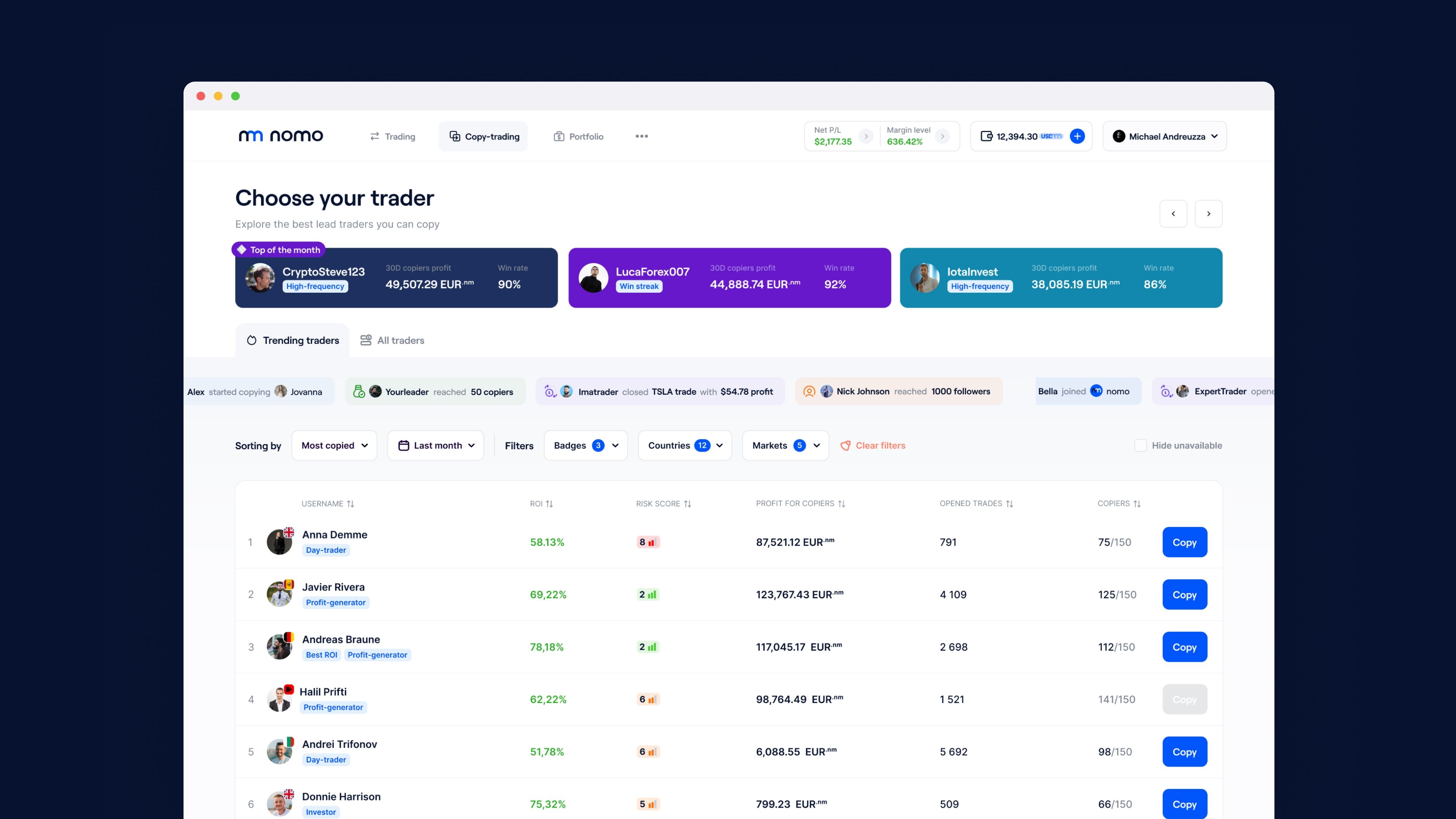

📌 Advanced Search Filters: nomo offers search filters that let you find traders based on specific criteria such as profitability, risk level, and asset types. Use these filters to refine your selection.

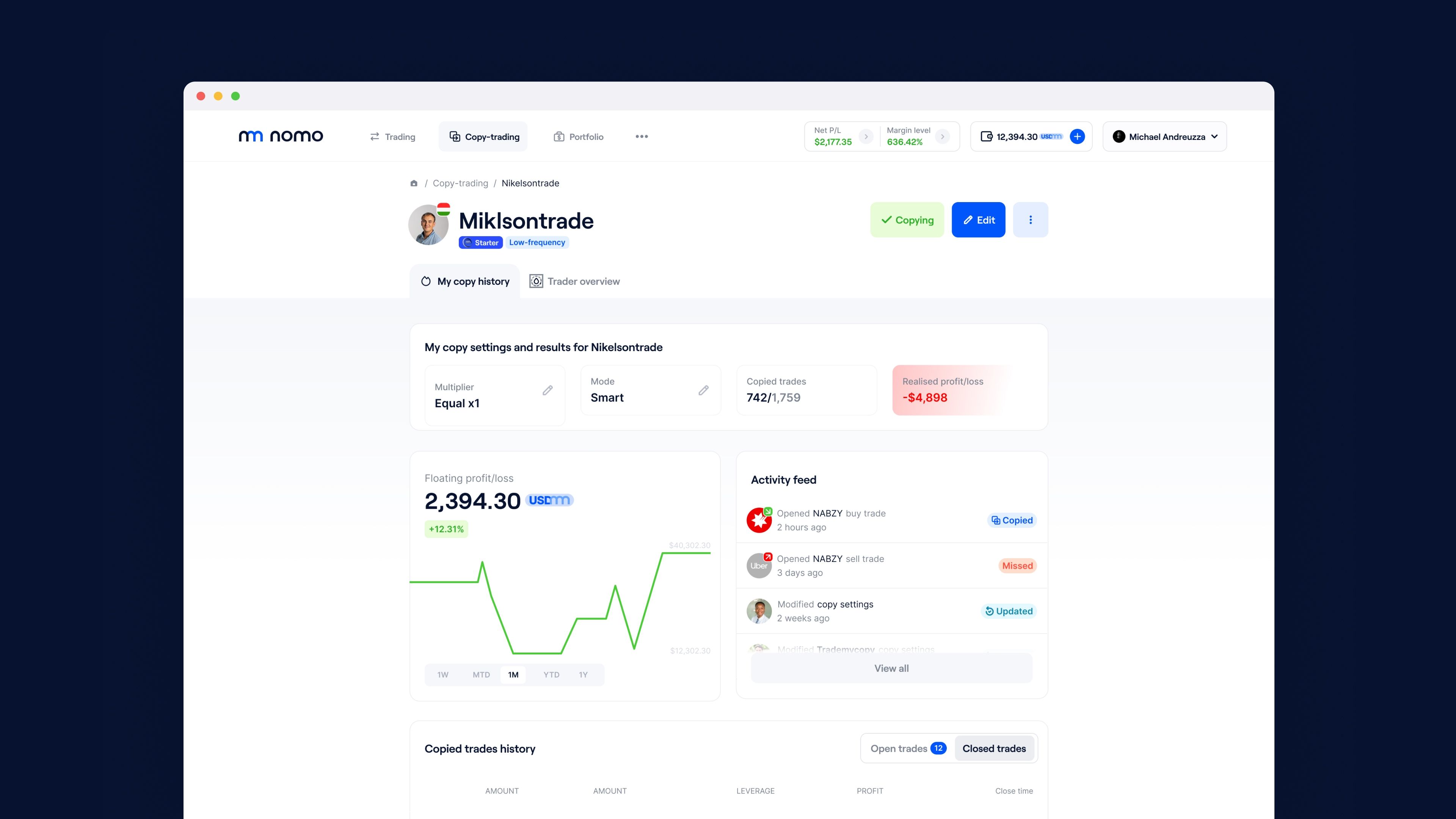

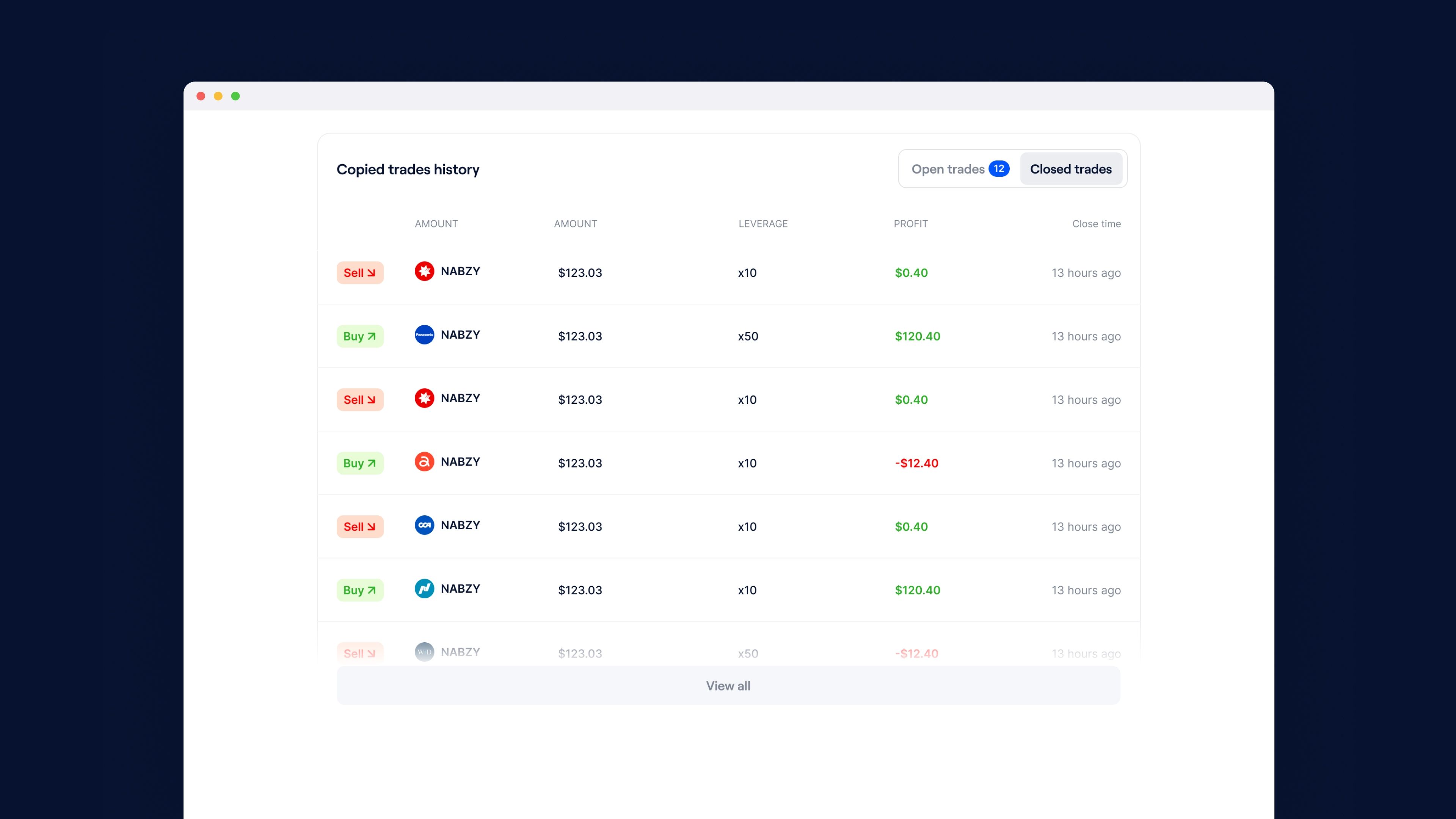

📌 Copiers Dashboard: nomo’s copier dashboard allows you to track the real-time performance of the traders you’re copying, making it easier to monitor your investments.

📌 Performance Metrics: Study key metrics provided by nomo, such as successful trade percentages, monthly returns, and volatility levels, to make informed decisions.

Aligning your trader choice with your risk tolerance

✅ Define Your Risk Profile: Determine your own risk tolerance and ensure that the trader you choose aligns with your investment style. If you prefer a low-risk approach, opt for traders with more stable and conservative strategies.

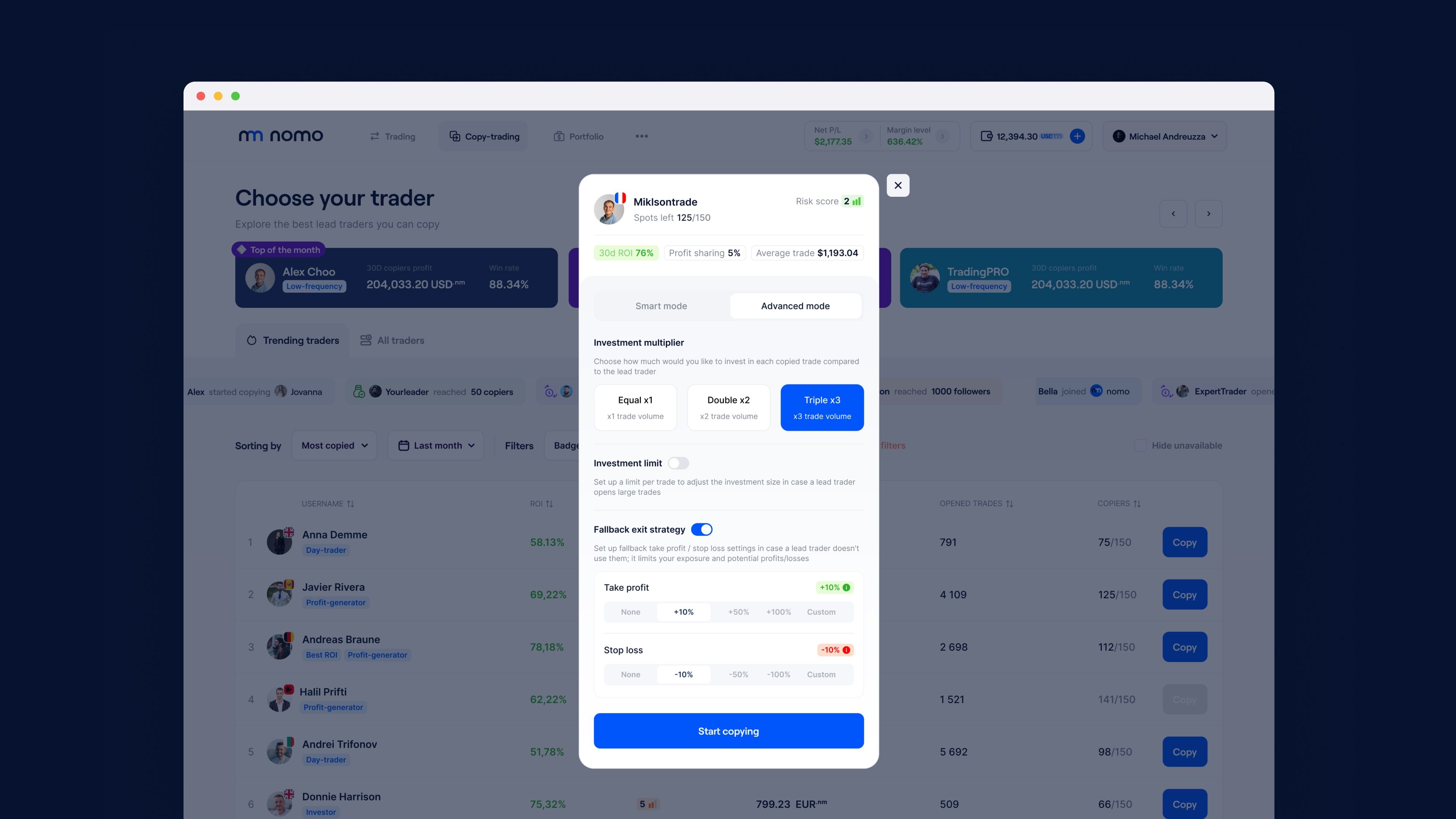

✅ Adjust Your Investment Amount: nomo allows you to customize your investment multiplier, letting you control how much capital you allocate and manage your risk effectively.

Final recommendations

💡 Diversify Your Copied Traders: Avoid putting all your funds into a single trader. Copying multiple traders with different strategies can reduce risk and increase potential returns.

🔎 Monitor Performance Regularly: While copytrading is a passive investment method, it’s essential to check the performance of the traders you’re copying and adjust your strategy as needed.

By following this guide and leveraging the tools nomo provides, you can make informed decisions to maximize your profits and minimize risks in your copytrading experience. Remember, due diligence and continuous monitoring are key to long-term success in any investment. 😎

Ready to get started? Sign up on nomo today! 💻

If you're still unsure, check out this 👉 beginner's guide to copytrading.

Share

Similar articles