- /

- Blog /

- Copytrading /

- How to analyze market trends and trade smarter in any condition 🧐🎯

How to analyze market trends and trade smarter in any condition 🧐🎯

Learn to identify and leverage market trends using tools like moving averages, MACD, and ADX. Enhance your trading strategy with nomo's AI-powered solutions and practice risk-free with a $10,000 demo account.

Analysis

Share

Wondering when's the right time to enter or exit the market? Understanding market trends is one of the pillars of successful trading. Whether you're trading forex, stocks, or crypto, identifying the direction of price movements lets you act with greater confidence and avoid impulsive decisions.

This guide shows you how to spot bullish, bearish, and sideways trends, which tools to use to analyze them, and how to adapt your trading strategy to different market phases. If you're a beginner, this will be an essential roadmap to trade with logic, not luck.

What is a market trend and why does it matter?

A market trend indicates the general direction in which an asset's price is moving over a specific period. Trends can be:

🔼 Uptrend (Bullish): The price rises consistently, reaching higher highs and higher lows.

🔽 Downtrend (Bearish): The price falls steadily, forming lower highs and lower lows.

➡️ Sideways (or range-bound): The price moves within a horizontal range, without a clear direction.

Identifying these trends helps traders align their strategies accordingly, reducing the risk of losses from counter-trend trades.

How to identify a real trend: practical steps

Even though it may seem easy, recognizing a valid trend requires watching for certain patterns and using reliable tools. Here’s how to do it step by step:

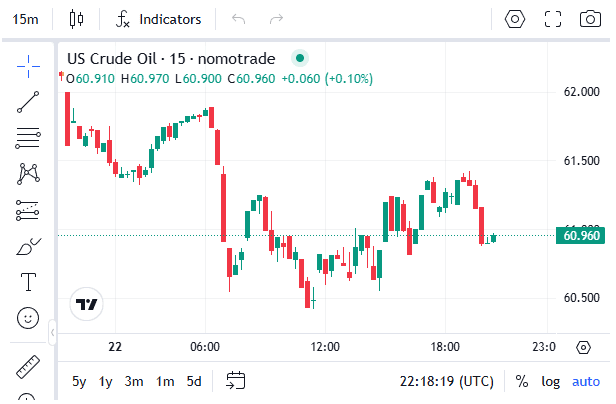

1️⃣ Analyze price charts

Charts are your roadmap. Start with candlestick charts, which clearly show price action in detail. Look for:

🔼 In uptrends, you'll see a sequence of rising highs and lows.

🔽 In downtrends, expect falling highs and lows.

➡️ In sideways trends, highs and lows stay within a narrow range.

2️⃣ Utilize technical indicators

Technical indicators are your best allies for confirming what you see on the chart:

〰️ Moving Average (MA): Smooths out fluctuations and highlights the overall price direction.

👉 If price is above the MA, the trend may be bullish.

👉 If below, it could suggest a bearish trend.

📈 MACD (Moving Average Convergence Divergence): Highlights changes in momentum and trend direction.

⚡ ADX (Average Directional Index): Measures the strength of a trend, regardless of its direction. An ADX above 25 signals a strong trend; below 20, a ranging market.

Essential tools for trend analysis

Here’s how to apply three key technical tools to better understand and anticipate market moves:

✅ Trendlines

Drawn by connecting significant highs or lows, trendlines help identify support and resistance levels.

✅ Moving Average Crossovers

A short-term MA crossing above a long-term MA may signal the start of an uptrend, and vice versa.

✅ MACD + ADX Combo

Using both indicators together can provide a clearer picture of trend direction and strength.

Trading strategies based on trends

Once you’ve identified a trend, the next step is knowing how to act. Here are two popular strategies:

📈 Trend-following strategy

Based on the idea that “the trend is your friend.” Enter trades in the direction of the prevailing trend, using tools like MA crossovers for confirmation.

This approach relies on:

👉 Technical confirmations (e.g. MA crossovers)

👉 Disciplined use of stop loss to limit losses

👉 Setting take profit levels to lock in gains without overtrading

🧠 Example: If you’re in an uptrend and the price pulls back to a 50-day moving average or trendline, it could be a strong entry point for a long position.

⚠️ Trend reversal strategy

Identify potential trend reversals using indicators like RSI (Relative Strength Index), which can signal overbought or oversold conditions:

👉 RSI > 70: The asset may be overbought—possibly signaling a drop.

👉 RSI < 30: The asset may be oversold—potentially indicating a bounce.

The key is to wait for extra confirmation (like reversal candles or false breakouts) before taking action.

Multi-timeframe analysis: A comprehensive view

Analyzing multiple timeframes provides a broader perspective:

💡 Long-term (weekly or monthly): Identifies the primary trend.

📋 Mid-term (daily): Helps spot potential entry and exit points.

💥 Short-term (hourly/15-minute): Assists in fine-tuning entry and exit timing.

Aligning trends across timeframes can increase the probability of successful trades.

Practice risk-free with nomo’s demo account

Before committing real funds, practice with nomo's free demo account, which includes $10,000 in virtual capital. This allows you to:

🔥 Experiment with technical tools like MA, MACD, ADX, and RSI.

🔥 Test trend-following and reversal strategies.

🔥 Develop risk management and trading discipline.

If you're new to trading and prefer to learn by watching others, nomo's copytrading feature is a great place to start. With just a few clicks, you can follow real traders who apply trend analysis in their daily strategies and gain insights by seeing exactly how they trade.

Looking to level up your trading? Take your trading to the next level with the nomo AI Index.

This innovative tool combines artificial intelligence with proven strategies to manage your investments efficiently. The AI Index analyzes multiple traders and strategies in real-time to create an optimized portfolio, ideal for those seeking performance with controlled risk.

✅ Choose your investment amount.

✅ Let the AI adjust your portfolio.

✅ Explore its features and see the results.

At nomo, we believe the best way to learn to invest is by combining theory with action. Your demo account is the safest place to try, fail, and grow.

Let the trend be your guide

Mastering trend analysis is more than drawing lines or following indicators; it's about understanding market behavior. With consistent practice and the right tools, you can move from guesswork to informed trading decisions.

📌 Utilize tools like MA, MACD, and ADX, incorporate multi-timeframe analysis, and practice in a risk-free environment with nomo's demo account. This approach lays the foundation for becoming a confident trader.

👉 Ready to apply these insights? Open your free demo account with nomo and start analyzing the markets like a pro.

Share

Similar articles