From scroll to strategy: Why Gen Z is turning to copytrading and social investing 📱✨

Gen Z is reshaping investing in 2025. Learn how copy trading, social trading platforms, and AI tools are driving new trends in digital, collaborative, and accessible investing.

Copytrading

Share

Born into a hyper-connected world, Gen Z is reshaping how we think about investing. Forget the suits and Wall Street jargon, this generation is embracing social trading platforms that offer something more relatable: real-time learning, community, and smarter tools. In 2025, copytrading isn’t just a trend, it’s a movement that reflects Gen Z’s values and digital-first mindset.

Digital natives, community-driven investors

For Gen Z, investing isn’t just about returns, it’s about experience. Raised on platforms like TikTok, Reddit, Discord and Telegram, they’re used to fast content, shared opinions, and viral conversations. Social trading platforms like nomo fit right in. They allow users to connect, explore, and invest alongside seasoned traders, all from their phones.

This seamless blend of collaborative investing and technology turns trading into something social, transparent, and approachable—qualities Gen Z actively seeks in the financial world.

Learning by doing: Copytrading for beginners

Rather than digesting endless theory, Gen Z prefers practical, in-the-moment learning. That’s where copytrading platforms shine. They allow young investors to follow the strategies of professionals, track their performance in real-time, and even replicate their moves automatically.

This hands-on approach lowers the barrier to entry and gives beginners the confidence to get started, without needing years of experience or technical know-how.

Transparency, purpose, and control over their money

Gen Z is highly skeptical of traditional financial institutions. They’re looking for platforms that offer full transparency, purpose-driven tools, and control over their decisions. That’s why investing apps for Gen Z need more than a pretty interface—they must show real data, track records, risk levels, and meaningful results.

Platforms like nomo respond to this need, helping users make informed choices aligned with their personal values and goals.

The role of AI in investing

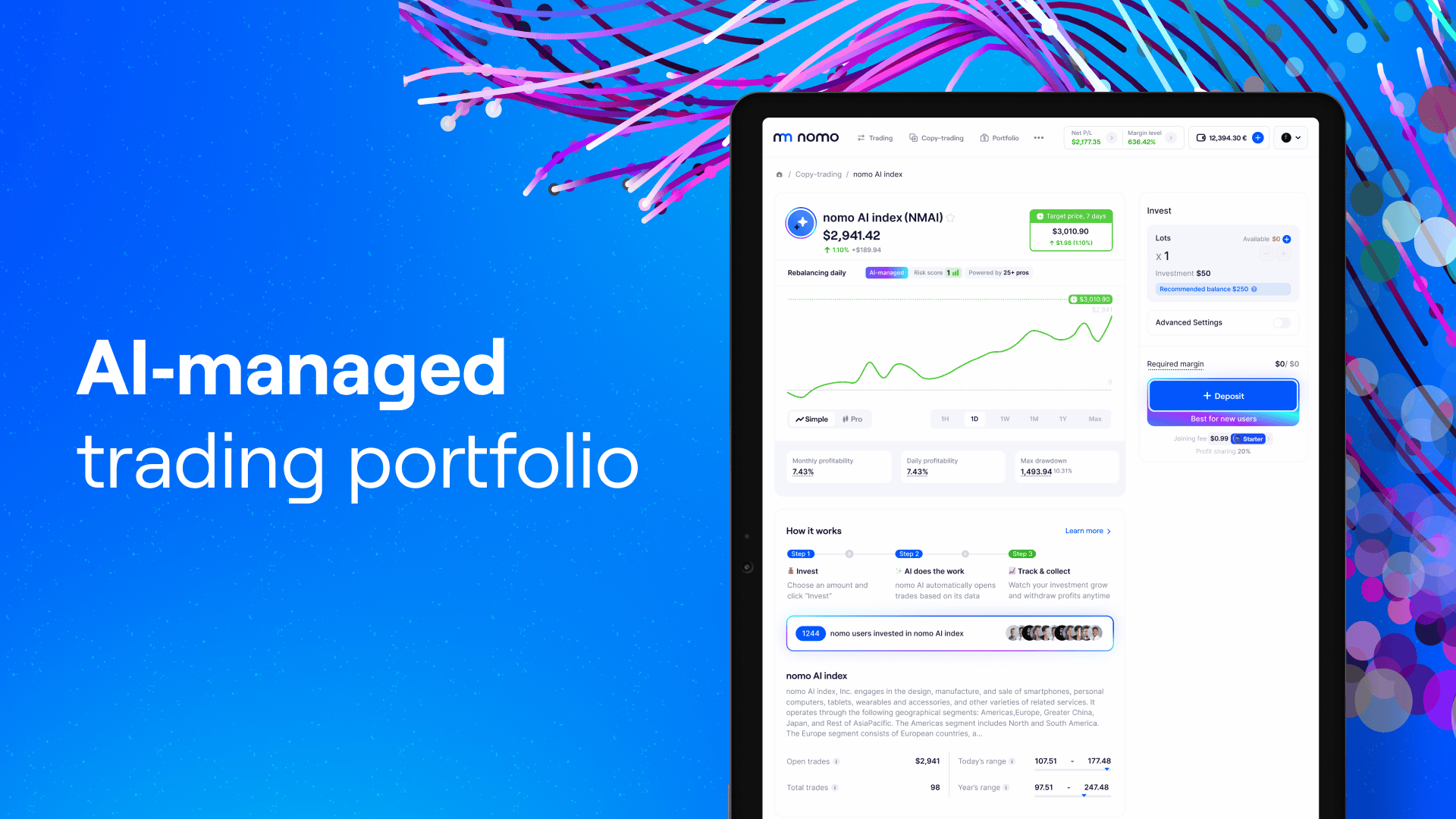

In 2025, AI in investing isn’t futuristic, it’s expected. Gen Z investors want intelligent tools that simplify decision-making, offer personalized recommendations, and support smarter automation.

With features like nomo’s AI Index, users can access AI-powered strategies and monitor their performance through real-time metrics. The result? A more rational, data-driven way to build a portfolio in tune with global trends.

From individual traders to community builders

Gen Z doesn’t idolize financial “gurus.” Instead, they seek collaborative investing experiences where knowledge, results, and strategies are shared. This shift is giving rise to a new financial culture, one where group achievements are celebrated as much as personal wins.

Being part of a community, asking questions, sharing outcomes, and growing together is what drives engagement for this generation.

The future of investing speaks Gen Z

Digital investing trends are evolving—and Gen Z is leading the way. They want simplicity, purpose, and real connections. They choose platforms that reflect their lifestyle and values. With tools like copytrading, AI-driven strategies, and social communities, investing becomes not only accessible, but empowering.

In this new era of social trading trends, platforms like nomo are redefining the game—making investing feel less like a solo mission and more like a shared journey.

Share

Similar articles