- /

- Blog /

- Copytrading /

- AI copytrading strategies for smarter investing 🤖

AI copytrading strategies for smarter investing 🤖

Boost your trading strategy with AI-powered copytrading. Discover how nomo AI Index automates smart decisions, diversifies your portfolio, and adapts to market changes.

AI

Share

In today's fast-moving markets, success isn't just about timing your trades, it's about making decisions with intelligence. And we don’t just mean your own. We’re talking about artificial intelligence.

If you’ve ever felt trading wasn’t for you because of a lack of experience, time, or confidence, think again. With tools with AI, you can now access professional, automated trading strategies tailored to your goals, even if you’re just starting out.

Why AI copytrading is a game-changer

Traditional copytrading lets you follow a single trader and mirror their moves. It’s simple, but risky, what if they have an off week or their strategy doesn’t fit your style?

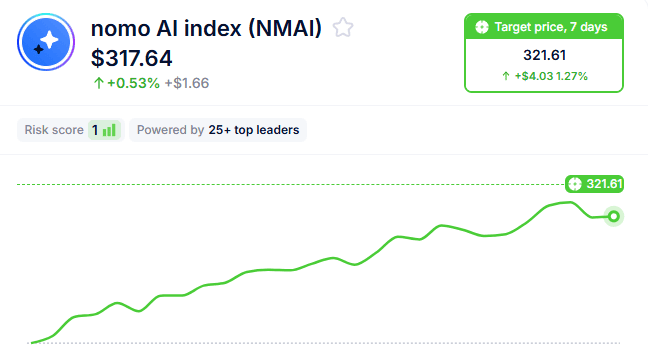

That’s where AI makes the difference. With nomo AI Index, you’re not copying one person, you're tapping into a collective intelligence trained on the behavior of dozens of top-performing traders. The system uses machine learning models to filter, combine, and optimize decisions, updating constantly based on what’s working now.

A real edge for the modern investor

Trading with AI isn’t just convenient, it’s a competitive edge. First, it removes emotional decision-making. Second, it gives you built-in diversification without needing to analyze dozens of charts. Third, it adapts in real time.

Unlike a fixed strategy, the nomo AI Index evolves. When the market shifts, the strategy adjusts. The result is a smoother, smarter trading experience, no technical skills required. Just activate the index and let the system handle the rest.

How nomo AI Index works

nomo’s AI scans real-time performance data from its top traders, including metrics like trade frequency, position size, stop-loss levels, and risk exposure. From there:

1️⃣ It cleans and processes the data.

2️⃣ It applies deep learning models (including Transformer and neural networks).

3️⃣ It validates performance using indicators like Sharpe Ratio and drawdown.

4️⃣ It executes trades directly through MetaTrader 5.

5️⃣ It retrains itself every 1 to 3 months to stay ahead of the curve.

This process ensures that what you're copying is optimized, updated, and based on measurable consistency, not hype.

Is AI copytrading just for experts? Absolutely not

One of the biggest misconceptions is that AI tools are only for experienced traders. In reality, AI makes trading more accessible than ever.

If you're new to trading, the nomo AI Index is a stress-free entry point. Set your budget, activate the tool, and the AI does the rest automatically. If you're intermediate, it’s a great way to diversify part of your portfolio without micro-managing. And even advanced traders use it to complement their manual strategies or stay active during off hours.

Best practices to maximize your AI strategy

📝 Set clear goals. Are you focused on growth, capital preservation, or passive returns?

💼 Review your portfolio every 1–3 months. Even with automation, it’s smart to stay aligned with your financial objectives.

🛑 Use stop-losses. Protect your capital from extreme market moves.

🦾 Combine AI with manual copytrading. You don’t have to choose — a blended strategy offers the best of both worlds.

The future of copytrading is smarter and it’s here

AI isn’t a futuristic promise. It’s already reshaping how people invest. With nomo AI Index, you don’t need to be a full-time trader or a data expert, just someone ready to invest intelligently.

Whether you’re new or experienced, it’s time to level up your strategy.

Activate nomo AI Index and let the system trade smarter for you. 📈

Share

Similar articles